Ĭommonly, quitclaims are used in situations where a grantor transfers any interest they have in property to a recipient (the grantee) but without offering any guarantee as to the extent of that interest. Originally a common law concept dating back to Medieval England, the expression is in modern times mostly restricted to North American law, where it often refers specifically to a transfer of ownership or some other interest in real property. A person who quitclaims renounces or relinquishes a claim to some legal right, or transfers a legal interest in land. Generally, a quitclaim is a formal renunciation of a legal claim against some other person, or of a right to land. The language is based on the basic precept of contract law that a contract (including a deed for the transfer of property) is not valid without consideration.Renunciation or transfer of land rights Property law

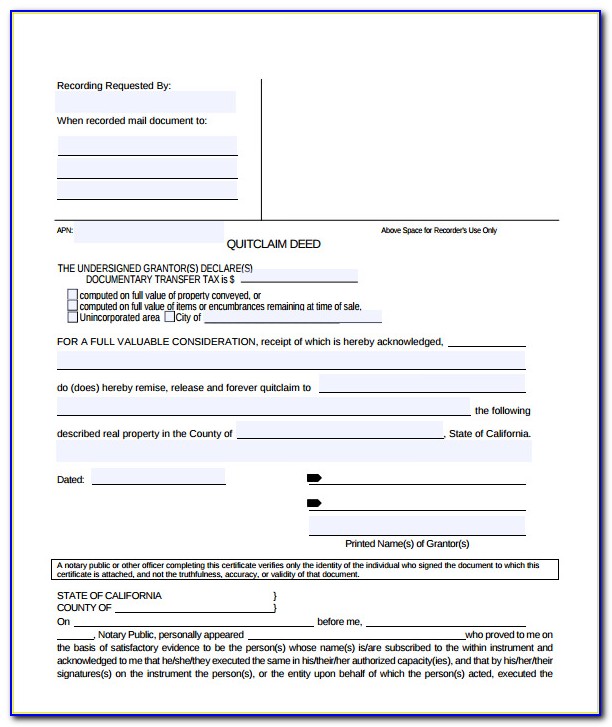

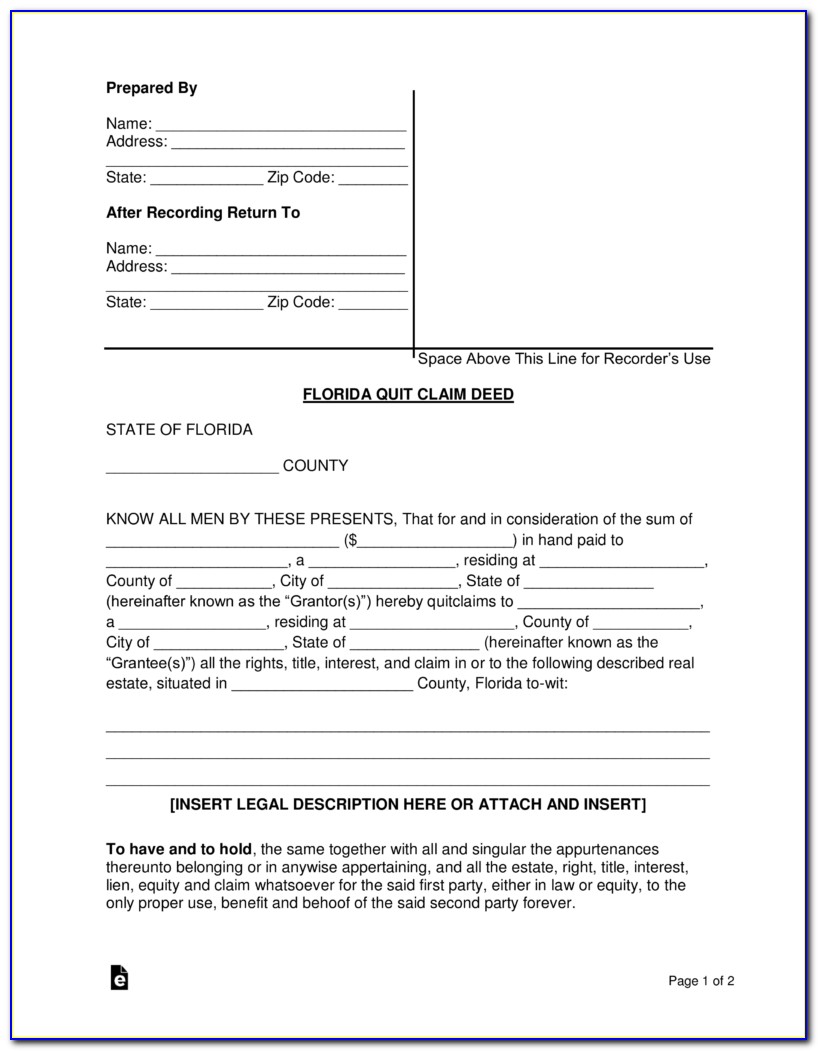

Most states do not allow you to transfer an interest you don't acquire until after the date of the transfer.The quitclaim deed in and of itself does not make the grantee responsible for that mortgage. This means if you have a mortgage on the property, you typically are still responsible for that mortgage unless you make other arrangements. Keep in mind that a quitclaim deed only transfers any interest you have at the time of the transfer.X Research source X Research source X Research source However, in some states you'll need to note whether mineral rights are included. A quitclaim deed simply transfers any interest you have in the property – even if you have no interest at all. A quitclaim deed also may not be the appropriate document if you are actually selling the property and a significant amount of money will be changing hands.įill in information about the transfer.In that situation, the other party may want a little more of a guarantee that they're getting exactly what they think they are.On the other hand, if the person to whom you're transferring the property is under the impression that you have a particular ownership interest in the property, a quitclaim deed may not be the right vehicle of transfer.For example, if there's some question as to whether you might have a claim to the property as a result of some confusion in the current owner's estate documents, but you don't want the property, you might use a quitclaim deed to negate any possible claim the probate judge decides you have in the property.You may have no interest at all, and that may match the intent of the transfer. Keep in mind that a quitclaim deed comes with no guarantee regarding the ownership interest you may have in the property.Quitclaim deeds are most frequently used between family members or co-owners of property who are already familiar with the property itself as well as with each other. Any questions regarding the transfer of property taxes and future tax liability should be directed to an accountant or tax professional.Ĭonfirm you're using the right kind of deed.If you're unsure about the tax status of the property, you can check the county recorder or tax assessor's records for the property, or look on the most recent property tax statement.

QUIT CLAIM DEED FORM FLORIDA FULL

However, if you paid the property taxes on the property, you'll have to make sure the taxes are paid in full up to the date of the transfer, and that the tax liability is transferred appropriately.If that is the case, tax statements typically will continue to be sent to the person to whom they've been sent in the past.Transferring your interest in the property may have nothing to do with property taxes, particularly if someone else was already paying the property taxes on the property.Transferring property doesn't necessarily transfer the tax obligation, and in most states the property taxes must be up to date if you want to transfer any interest in the property.

0 kommentar(er)

0 kommentar(er)